The Key to Mastering Real Estate Investing in the GTA

Clarity of Objectives in Real Estate Investment

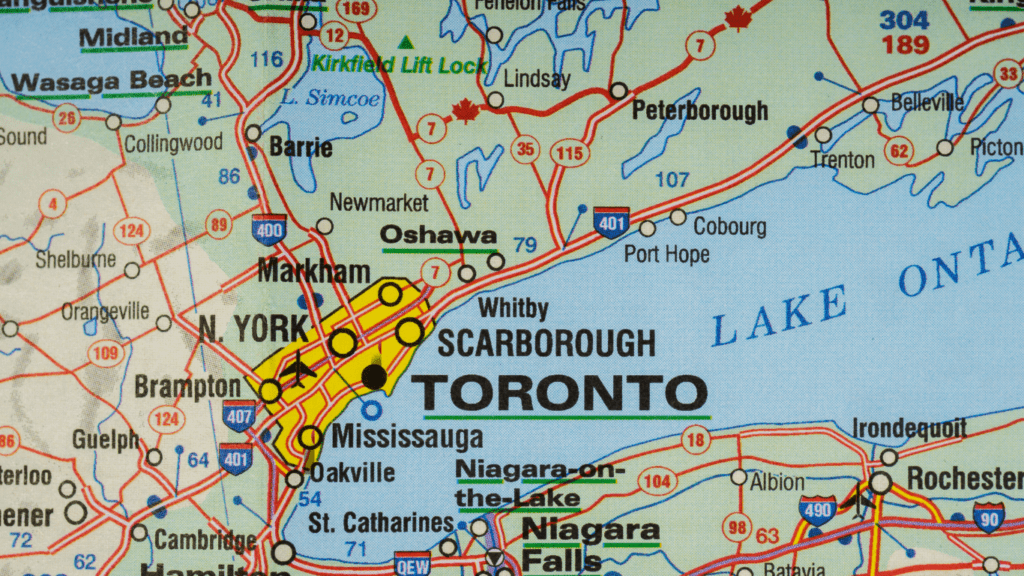

Mastering real estate investing in the Greater Toronto Area (GTA) begins with an exciting venture: embarking on your investment journey. However, success hinges on having a clear understanding of your investment objectives. Are you looking for immediate cash flow, long-term appreciation, or a steady build-up of equity? Each goal requires a unique approach and understanding of the market.

Defining Your Investment Goals

Start by defining what you hope to achieve with your investment. Do you want to generate a steady monthly income, or are you looking at the long-term growth of your capital? This decision will influence the type of properties you consider and the locations you target within the GTA.

Analyzing Cash Flow for Rental Properties

Cash flow is the lifeblood of any rental investment. It’s the net income you receive from the property after accounting for all overheads like mortgage payments, property taxes, maintenance costs, and insurance.

Case Study: Duplex Investment Scenario

Consider a duplex in the GTA priced at $950,000, offering two rental units with a combined rent of $6,000 per month. After deducting monthly costs totalling $4,500, your net cash flow stands at $1,500. This scenario translates into an annual surplus of $18,000, significantly bolstering your investment portfolio.

The Importance of Cap Rate in Property Investment

The capitalization rate, or cap rate, is a crucial metric used to assess the potential return on an investment property. It indicates the property’s natural rate of return in a single year without considering financing.

Evaluating Cap Rate with a Mississauga Townhome Example

For instance, a high-end townhome in Mississauga valued at $1,200,000 with a yearly net operating income of $72,000 after expenses would have a cap rate of 6%. This figure is obtained by dividing the annual income by the property’s value. It offers a clear indicator of what you can expect to earn, excluding financing costs.

Calculating ROI for Your Real Estate Ventures

The Return on Investment (ROI) is a comprehensive metric that encompasses the overall efficacy of your investment. It weaves together cash flow, mortgage principal reduction, and property value appreciation to give you a complete picture of your investment’s performance.

ROI Analysis on a Victorian House in Brampton

Consider a Victorian house in Brampton valued at $1.1 million. With an annual cash flow of $24,000, a mortgage paydown of $8,000, and an appreciation of $55,000 over the year, the total gain is $87,000. Comparing this with the initial investment provides an ROI of approximately 7.9%, a robust indicator of the health of your investment.

Conclusion

Mastering these key metrics – cash flow, cap rate, and ROI – is essential for any real estate investor in the GTA. Understanding and applying these concepts can lead to informed decisions and successful investment outcomes. For expert guidance and deeper insights into the GTA real estate market, consider partnering with The Keith and Françoise Real Estate Team. Their knowledge and experience can be invaluable in navigating this competitive landscape.

Back to Income Properties in Ontario: Building Steady Streams of Revenue.